Billing Cycles

| How do I get here? | Setup ► Customer Settings ► Billing Cycles |

| Purpose |

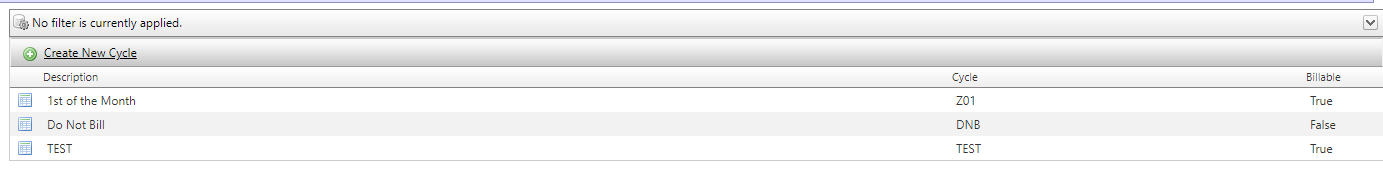

Billing Cycles determine when an account will bill during a month. An account can only be tied to ONE billing cycle. It is strongly recommended that a billing cycle not be changed on an account if the account has previously billed to avoid over/under charges for a period of time. A Billing Cycle can be designated as "Billable" which will allow it to be selected on an account. Billing Cycles that are not flagged as "Billable" cannot be scheduled or tied to an account. An example of this would be for a "Disconnect" or "Do Not Bill" cycle where the accounts on this cycle are no longer billing. Billing Cycles also determine the underlying Payment Processor the account is allowed to use. This would be for both ACH, Credit Cards and NACHA. |

| Security | Maintenance Module |

| Taxing Impact | N/A |

| Commission Impact | Commission Flag |

| Data Field Definitions | View Here |

A client can have multiple Billing Cycles setup in the system. These are then tied to customers to indicate the day of month the customer will be picked up for billing. Billing cycles are used within the Billing Control Panel to "schedule" a bill run.

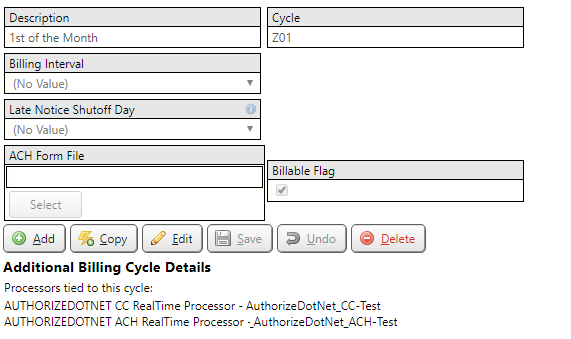

Details of a Billing Cycle record.

Description – description for the Billing Cycle. This value is shown in the dropdown on the Customer Information tab when applying to a customer. Ex. 1st of the Month

Cycle – abbreviated name for the Billing Cycle – ex. W

- This field is required

Billing Interval

|

Billing Frequency |

|

monthly - default |

|

weekly |

|

bi-monthly |

|

quarterly |

|

semi-annually |

|

Annually |

|

Biennial |

Finance Charge Start Day – the day of the month to start the finance charge (requires configuration by PTT)

- Example: If Finance Charge Start Day = 1, the system will apply the charge X days after the 1st of the month, where X is the number in the Start Finance Charge field on the Bill Setup tab for an account on that Billing Cycle.

ACH Form Full File Name – the location of the ACH Authorization Forms, which a customer on a particular cycle is required to fill out and return to set up ACH payments on their account

Billable Flag – if checked, this cycle currently bills

Super User Only

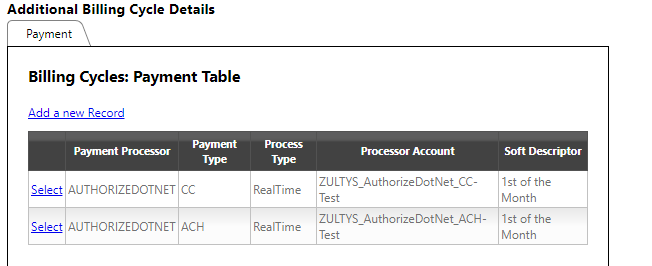

Each Billing Cycle can have a credit card and ACH payment processor associated with it for Batch and Real Time.

![]() The managed data can be found in the T4BillingCyclesPayment table.

The managed data can be found in the T4BillingCyclesPayment table.

Payment Processor

Examples: AUTHORIZE.NET, LINKPOINT, EPX, USAEPAY, PAYFLOW, NACHA, IPAY

- This field is required

- The options in this drop-down list can be maintained by using the Payment Processors Management Tool

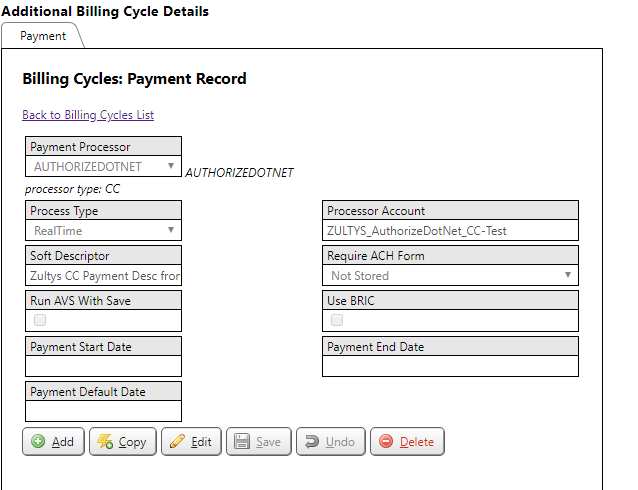

Process Type

- Real Time - when a customer makes an online ACH or credit card payment, the payment information is conveyed to the payment processor immediately

- Batch - many individual credit card or ACH transactions are collected into a single file and uploaded to the payment processor such that all transactions are processed at the same time. Responses are received via a response file vs. real time.

- This field is required

The options in this drop-down list can be maintained by choosing Admin > Drop Down Lists from the Main Menu

List Name – ProcessType

- Provides a link between the Payment Processor Service within PTT and TBS

- This field is required

Soft Descriptor – the description that appears on the customer’s credit card or bank statement to identify which business (client) charged the credit card

Require ACH Form

Check if,

- The payment processor is for ACH

AND

- The customer must return an ACH Authorization Form in order to use the payment processor

Run AVS With Save – if checked, an AVS (Address Verification Service) request is sent to the payment processor to verify the address before it saves the credit card or ACH record

Use BRIC – if checked, a unique identifier is used when communicating with the processor vs. sending the credit card number each time. This BRIC is used for all transmissions to the processor until information on the card is changed. At that time, a new BRIC would be generated and used going forward.

- BRIC - BuyerWall Recognized Identification Code

Payment Start Date – minimum date listed in the Select Payment Date drop-down list which appears when selecting a credit card or ACH account on the Automatic Payments to set for recurring payments

Payment End Date – maximum date listed in the Select Payment Date drop-down list which appears when selecting a credit card or ACH account on the Automatic Payments to set for recurring payments

Payment Default Date – the “Std. Date” Select Payment Date drop-down list option which appears when selecting a credit card or ACH account on the Automatic Payments to set for recurring payments if a specific date is not selected.